Commercial

Commercial Motor Insurance

Commercial Motor Insurance

We are all aware of how essential Motor Insurance is for our private vehicles but if your business uses vehicles for any purpose, whether that’s picking up goods, delivering products or visiting customers, then you need our Commercial Motor Policy.

This comprehensive motor insurance is available to corporations and individuals alike and offers four areas of protection:

- Own Damage: We offer compensation if your insured vehicle is damaged

- Liabilities to Third Parties: If you’re involved in an accident, we cover the legal liabilities to the third party

- Towing: We cover the use of the insured vehicle for towing another damaged vehicle

You can also strengthen and customize your policy even more with other motor insurance extensions. If you would like to learn more about this policy and how it can benefit your business, contact us today. We’d be happy to offer a sample copy of the Policy and help you find the perfect option for your needs.

Request a Call

Commercial Property Insurance

Fire Commercial

Fire can be one of the largest natural threats to your company. Although you try your best to prepare for such an occurrence with preventative measures like evacuation plans and extinguishers, the destructive and unpredictable nature of fire can still hurt your business. With our Commercial Fire Policy, you can safeguard your assets before they go up in flames.

Our comprehensive plan protects against:

- Fire

- Bush Fires

- Spontaneous Combustion

- Lightning

- Explosion

- Riot and Strike

- Malicious Damage

- Hurricane

- Windstorm

- Earthquake and Volcanic Eruption

- Flood

- Burst Pipes

- Smoke Damage and much more.

This plan also covers the property of the insured as well as buildings, walls, gates, fences, plant, machinery and equipment, stock, furniture, fixtures and fittings and all other contents.

To learn more about this policy and how it can protect your business, send us an email at i[email protected].

Small Business (BizSecure)

As a small business owner, you probably have a lot on your plate as you try to grow your business. Don’t let mishaps get in the way of your biggest dreams. Protect the future of your business with our BizSecure Policy, a plan specially designed to meet the insurance needs of small businesses.

Our affordable and comprehensive policy protects businesses with an annual turnover rate of between $250,000 to $3,000,000 by covering against misfortunes that can devastate a small business such as Fire and Special Perils, Loss of Money, Fidelity Guarantee, Burglary, Goods in Transit, Liability and Business Interruption.

The Policy is subject to various Conditions, Exceptions, Limits and Excesses. A sample copy of the Policy is available on request so email us today at [email protected] to learn more about this policy and how it can help protect your investment.

Request a Call

Commercial Marine Insurance

Marine Hull Insurance

Marine vessels are costly investments for your business. If they are damaged, that can spell disaster or can even hinder your business operations. That is exactly why we’ve worked to build a comprehensive and competitive Commercial Hull policy that will protect your investment from any damages or losses that can happen.

This policy is built to cover a variety of vessels, whether that is charter vessels, commercial fishing vessels, small work boats, tugs and even barges.

Let us show you how this policy is perfect for keeping your assets afloat. Contact us today at [email protected] and our trained customer service representatives will be happy to assist you.

Marine Cargo Insurance

Does your business regularly import or export products? What would happen if a shipment is lost or damaged? How would your business be affected? With Tatil’s Commercial Cargo Policy your goods are protected from physical loss or damage when shipped by sea or air or being transported from one warehouse to another.

Let us help you breathe a little easier, knowing your products are protected.

Email us at [email protected] today and our trained customer service representatives will be happy to assist you.

Request a Call

Commercial Engineering Insurance

Computer All Risks

In the fast-paced, digitalized world we live in, you can never be too careful about keeping your work devices safe. A simple accident could cause lost time, money and major setbacks on the job. An All Risks policy from Tatil is built to protect your valuable computer hardware and ancillary equipment.

Help prevent some of the stress and costly setbacks caused by unforeseen loss or damage to the technologies you need to get your job done. Call or email us today to get your devices covered!

This policy is subject to various Conditions, Exceptions, Limits and Excesses. Our friendly Tatil agents can also make a sample copy of the policy available at your request. Get started today by visiting our website or sending us an email at [email protected].

Contractor’s All Risks

Get the coverage you need to get the job done! Being a contractor, we know you are committed to your staff, clients and workspace and give every one of your projects your all. Our Contractor’s All Risks Policy is designed to cover you during any Construction or Civil Engineering projects.

Our Contractor’s All Risk policy helps to:

- Protect against unforeseen costs due to property damage and civil works during the contract period

- Protect the contractor from any legal liability for bodily injury and damage to third party property, within the terms of the contract

- Cover the construction plant and job site equipment

If you are a building contractor or contracted for a public sector project, ask one of our friendly customer service representatives about the Erection All Risks Policy so we can cater specifically to your needs.

This policy is subject to various Conditions, Exceptions, Limits and Excesses. Our friendly Tatil agents can also make a sample copy of the policy available at your request. Get started today by visiting our website or sending an email to [email protected].

Machinery All Risks

Protect the equipment you rely on every day to get the job done!

If you are an engineer, contractor or construction worker, you know the value of your machinery. You rely on your equipment and tools to make your job safer, easier and much more efficient. Loss or damage to machinery can have significant impacts on work timelines and can create unsafe working conditions for you and your employees. Don’t wait for your machinery to show signs of wear and tear before you consider insuring it.

Our Machinery All Risks Policy covers accidental loss and damage to your important equipment. This policy is subject to various Conditions, Exceptions, Limits and Excesses. Our friendly Tatil agents can also make a sample copy of the policy available at your request. Get started today by visiting our website or emailing us at [email protected].

Request a Call

Group Life Insurance

One of the most important assets a business can have is healthy and happy employees. Stand out from your competition and ensure your workers are well taken care of with our Group Life policy.

This policy offers the beneficiary of a deceased employee a lump sum payment on their death and can be customized to include additional benefits.

This flexible plan is a win-win for employers and employees alike. As an employer, most or all of your contributions qualify as a deductible business expense while your employees get quality insurance at an affordable price.

You can apply for this policy to cover as few as ten people. That makes this an excellent option for small businesses that are growing.

Coverage is based on a flat amount or a multiple of an employee’s annual salary. This figure can be adjusted based on the nature of the company business, the number of employees and their salaries. Coverage can last until age 60, 65 or 70 and can even include an additional retiree benefit.

If you would like to strengthen this policy, we offer a range of additional benefits such as:

- Total Disability Waiver of Premium: Premiums after six months of continued disability will be waived until the employee is able to work again

- Accidental Death and Dismemberment/Loss of Use: If the employee dies in an accident, the full amount of the Accidental Death is paid. If they lose a limb or the use of this limb a percentage of the Accidental Death is payable.

- Optional Group Life: This is a Group benefit to enhance the existing Group life coverage.

- Group Critical Illness: This benefit offers protection against major critical illnesses. We offer this coverage with either 11 or 13 illnesses.

If you would like to learn more about how this policy can improve your business, send us an email at life@tatil.co.tt and we would be happy to assist you!

Request a Call

Group Health Insurance

We offer Group insurance plans for small and large businesses. Give your hardworking employees the excellent healthcare coverage they deserve.

It’s no secret that employees who feel protected and supported by their workplace are more committed and invested in their work. Here at Tatil, we consider excellent health insurance not to be merely an employment benefit but a necessary provision for any workplace that is invested in the wellbeing of employees and their families.

As with any Tatil commercial insurance policy, we want you to have protection that is as tailor-made to your business’ needs as possible. This is why we offer two different Group Health Policies:

- The Small Groups Plan: A standard plan for employers with more than 5 but less than 25 employees

- For employers with over 25 employees, we offer specially designed coverage plans based on the specific work and needs of your company and its employees.

Both policies provide reliable and affordable coverage to:

- Full-time employees

- Spouses of full-time employees

- The children of full-time employees who are under the age of 19 years and who are not employed or married.

- The children of full-time employees who are enrolled full-time in school or university

All of the above parties are covered for:

- Hospital fees

- Surgeon’s fees

- Doctor’s visits

- Medical specialist’s consultations

- Physiotherapy expenses

- Prescription medications

- Maternity expenses

- Vision care

- Dental care

- Preventative care

- and other miscellaneous non-hospital care expenses

Give back to those who give you and your business their time and expertise by getting in touch with one of our representatives today.

Request a Call

Destiny Corporate Savings Booster

MANY EMPLOYERS ASK THESE QUESTIONS…

What level of income will my treasured employees need to live comfortably in retirement?

Will their resources be adequate to keep up with inflation and increased medical costs?

And while your employees may be happy with their current income and benefits, saving and investing wisely for retirement is often a challenge!

The Destiny Corporate Savings Booster offers a retirement plan designed to provide a tax efficient way of rewarding an organisation’s staff.

This flexible premium annuity is designed to provide them with tax sheltered growth and an enhanced income in their golden years.

HOW IT WORKS

Start by choosing an investment fund based on the appetite for risk:

- Settler No Risk, Highest Guaranteed Reward

- Explorer Moderate Risk with lower Guaranteed Minimum Reward

- Adventurer Highest Risk with Higher Possible Reward but the lowest Guaranteed Minimum Reward

Then, select the retirement date – any age between 50 and 70 years.

EMPLOYER BENEFITS

- Contributions made to this plan by the employer/company are an allowable expense under Section 134(6) of the Income Tax Act of Trinidad and Tobago, subject to limitations.

- The plan facilitates improved benefits for staff at no additional cost to the employer/ company other than the contributions that are paid.

- The employer owns the plan so must authorize any changes.

EMPLOYEE BENEFITS

- This plan is transferrable between employers/companys, thereby promoting portability for today’s mobile staff.

- The plan can supplement the employee’s existing retirement and pension provisions and provides a pre-tax savings solution which enjoys tax sheltered growth.

- There are no hidden charges applied to the employees’ savings and so 100% of contributions are invested.

- Plans provide employees with a full pension or tax-free lump sum of up to 25% of their fund with a reduced pension.

- In the event of death prior to the maturity date, the accumulated fund is paid to the employee’s named beneficiary or estate.

- Monthly income for employee’s retirement for life.

- Options of a lower pension in exchange for guaranteed continued payment in the event of death, to the beneficiaries, for the first 5, 10 or 15 years of retirement or for an additional income to be provided for the spouse when the employee has passed on.

Conditions apply.

Contact your Tatil Life financial advisor:

62TATIL (628-2845)

Life | Pensions | Mortgages | Critical Illness

Request a Call

Commercial General Accident Insurance

Burglary

In these uncertain times, it brings peace of mind to know your commercial property is protected.

We empathize with the responsibility our commercial clients feel towards their own clients and know that damages to commercial property affect not only business owners but the people they serve. This is why we suggest considering burglary insurance from as early as possible.

Tatil’s Burglary Policy is especially designed to protect the owners of commercial property from the out of pocket costs resulting from theft. This policy also covers damages to commercial premises resulting from forced or violent entry or exit. We recommend our Burglary Policy to both small and large business owners, especially those who store valuable equipment on their commercial premises.

Remember, the best time to buy insurance is always now, before the unforeseeable happens. This policy is subject to various Conditions, Exceptions, Limits and Excesses. Our friendly Tatil agents can also make a sample copy of the policy available at your request. Get started today by visiting our website or emailing us at [email protected].

Cash in Transit

Move safely with your money!

Transporting money can be risky for many reasons. While in transit, you may be particularly vulnerable to theft and accidents. Did you know that you can insure your cash with Tatil? Our Cash in Transit insurance option covers you from loss of money in transit to and from as well as cash on commercial premises both during and outside of business hours.

This policy is subject to various Conditions, Exceptions, Limits and Excesses. Our friendly Tatil agents can also make a sample copy of the policy available at your request. Get started today by visiting our website or emailing us at [email protected].

Goods in Transit

If your business transports your merchandise to your customers, moves products or even moves items from one location to another, then you need a Goods in Transit policy like ours. This policy covers you from specific risks related to the physical loss or damage to your property while it’s under your control and in transit anywhere in Trinidad and Tobago.

This policy is subject to various Conditions, Exceptions, Limits and Excesses. Our friendly Tatil agents can also make a sample copy of the policy available at your request. Get started today by visiting our website or emailing us at [email protected].

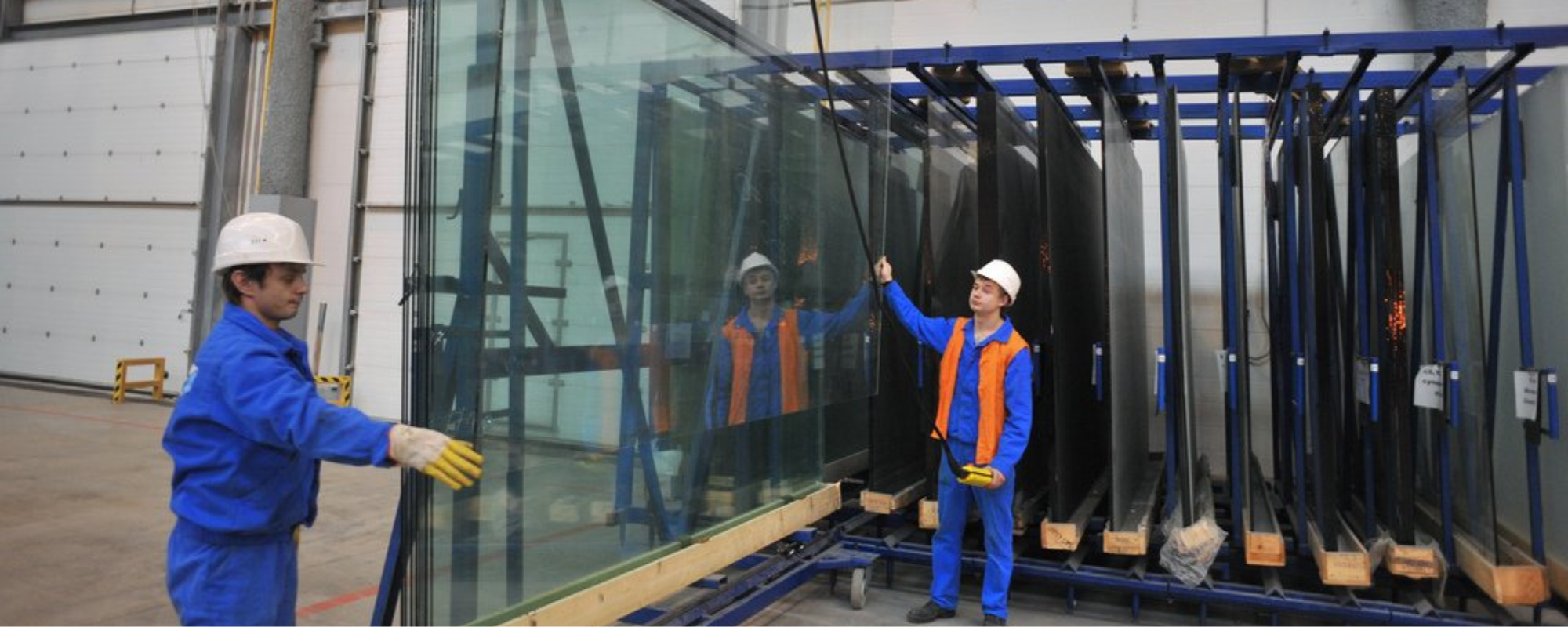

Plate Glass

Here at Tatil, we know the love and care that you’ve put into your business and that’s not including the financial costs as well. We want to help you protect your business and investments so we’ve created a policy that covers damages to your plate glass in shop fronts and display cases.

This policy is subject to various Conditions, Exceptions, Limits and Excesses. Our friendly Tatil agents can also make a sample copy of the policy available at your request. Get started today by visiting our website or emailing us at [email protected].

Request a Call

Commercial Liability Insurance

Public Liability

If your business is open to the public, then it’s open to liability. Your friends here at Tatil want to make sure that your interests are protected so we’ve built a plan that covers that liability to third parties for property damage or bodily injury to any member of the public as a result of your business operations.

Let us help you and your customers feel safer with a Public Liability plan from Tatil.

Workmen’s Compensation and Employer’s Liability

As an employer, there are a number of responsibilities you might not immediately think of. Let Tatil help take some of those responsibilities off your plate with our Workman’s Compensation and Employer’s Liability plan.

This plan works in two parts to ensure your protection.

- Workmen’s Compensation: If one of your employees were to become injured, your coverage provides for the cost of work related injuries or occupational diseases.

- Employer’s Liability: This covers negligence lawsuits which are made over work related injuries and occupational diseases.

Get in touch with one of our trained customer service representatives to get more information on this plan by emailing us at [email protected].

Request a Call

Contact Us

868-628-2845

Any time from 8am to 4:30pmRequest a Call

Contact Us

868-628-2845

Any time from 8am to 4:30pmRequest a Call